Deposit protection schemes exist in various walks of life in the UK, including housing rental, for example, but here we are concerned with how they apply to the world of online betting. The deposit protection scheme aims to give customers who use online betting sites in the UK some protection in the eventuality that the company they make a deposit with gets into financial difficulties.

Deposit protection schemes exist in various walks of life in the UK, including housing rental, for example, but here we are concerned with how they apply to the world of online betting. The deposit protection scheme aims to give customers who use online betting sites in the UK some protection in the eventuality that the company they make a deposit with gets into financial difficulties.

It applies to bookmakers, online casinos, online bingo operators and poker providers, as well – basically any site that operates using a license from the UK Gambling Commission (UKGC). In addition, it also covers real-world betting operators, such as bookmaker shops, and physical casinos and bingo halls. In fact, providing this protection and making customers aware of it, is a condition of the site being granted a license in the first place.

Where Can I Find Info on What Protection I Will Receive?

Online sites, which is what we are chiefly concerned here, must include details of what protection they offer in their terms and conditions. However, given the reality that few people actually bother with skimming through such small print, let alone reading it all, the UKGC state that such info “must be made available at the point when a customer deposits money. Information must be available in a manner which requires customers to actively acknowledge that they have read it.”

Indeed, they go on to point out that players should not be given access to their deposited funds until they have confirmed they understand the deposit protection scheme. Of course, many punters will simply tick the box without ever bothering to check or knowing what they are accepting but there is no real way around that.

If you do want to understand the level of protection your preferred bookie, casino or other gambling site provides, you should be able to find this in their terms and conditions. As said, they will also highlight this confirmation when you make a deposit, whilst their customer services team should also be able to assist.

What Is the Point of the Scheme?

The reason the UKGC has implemented this system is so that customers can easily gain a good understanding of what would happen to their money if the betting site they use goes bust. The UKGC explain that operators must explain their “arrangements for protecting the customer funds (they) hold in the event of insolvency, the level of that protection and the method (they) use to achieve this.”

The idea is that a customer, or a prospective customer, can then make a better-informed decision over whether or not to deposit funds with any given company. Once again, there is very probably a large divergence between theory and practice. In reality few punters understand the scheme and, frankly, even fewer care.

We strongly doubt that too many would-be bettors scour the internet to find sites with the best protection and eschew any that do not meet their exacting standards. In reality, most punters join a site because they want to claim a free bet or bonus, their friends use it, the app looks slick, or they like the look of their latest advert.

The vast majority of recreational punters do not countenance the idea that their bookie could go bust. Thankfully, most sites that fall under the better-than-average regulation of the UKGC are unlikely to become insolvent. Even so, as we have seen in the world of retail and elsewhere, even big brands can fail sometimes though, so we feel this is an issue that punters should give more consideration to.

What Does the Deposit Protection Scheme Offer?

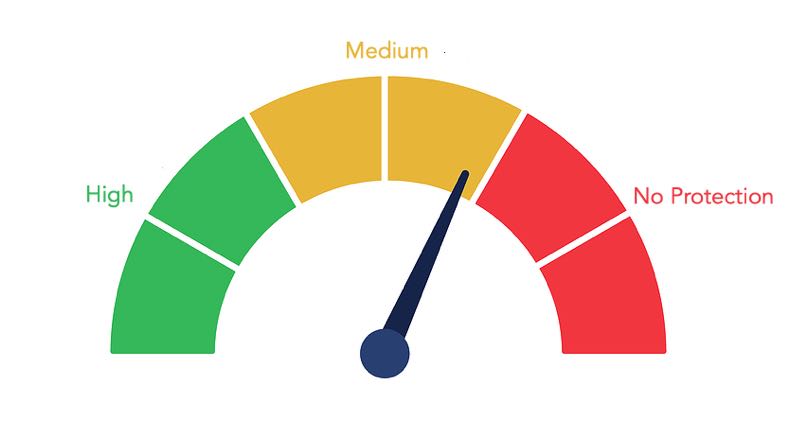

Under the scheme there are three levels of protection and every UK operator will offer one of these. They must notify you what level of protection your deposits will have when you fund your account. In addition, should they alter this, they should tell you in advance of any changes and also highlight these changes when you make future deposits. Customers will once again be asked to acknowledge that they are aware of the altered protection level.

The three tiers of protection are as follows:

- High – The best chance of getting your money back if the company went bust or got into difficulties

- Medium – Second best but funds are certainly not guaranteed

- No Protection – The lowest possible, meaning you would almost certainly lose funds of yours held by the company

High Protection

This is the gold standard and gives you the best possible chance of recovering your deposits and any winnings should your bookie, casino or other betting business enter insolvency. The UKGC note that this gives you “the best chance of getting your money back.” In this situation, your money is held separately from the finances of the gambling side of the business and is legally recognised as such.

An independent trustee and external auditor control and check these funds. As such, should such a betting site have financial difficulties, these funds will not be available for them to pay other debts, such as to marketing companies or overdue property rent for example.

Medium Protection

With medium protection, the UKGC explain, in bold type, that it is “not absolutely guaranteed” you will be able to get back whatever money of yours the company holds. The site in question must have put in place mechanisms to protect your cash in the event of insolvency. There are various acceptable options, such as insurance, but it is possible these may be insufficient for the company to pay all debts and customers.

No Protection

If a site affords you no protection you may want to think twice about playing or betting with them. This is not an indicator that they are untrustworthy, in financial difficulties or in any way dodgy. However, the fact remains that if they go to the wall, you will almost certainly lose whatever money was in your account with them. Such funds would legally be classed alongside all of the company’s other monies and assets.

This means that other entities who were owed money could be paid using “your” funds. There is a specific order of who gets paid first, with the likes of secured creditors and preferential creditors at the front of the queue. Customers are very much at the back of the queue, with the company that carries out the insolvency proceedings ahead of them, along with, basically everyone else.

Can I Check Which Sites Offer What Levels of Protection?

Whilst we have said that most punters probably have little interest in noting what protection their money has, we are equally sure that some do. What’s more, we would suggest that anyone risking their hard-earned funds indulging in a spot of gambling should be aware of how safe that cash might be.

As explained, the levels of protection a site possesses must be made clear. As such, you can check each site individually, either by reading their terms and conditions before joining or by joining and going through the preliminary stages of making a deposit. However, that is clearly quite a time-consuming process.

The UKGC licences a huge number of betting sites, both online and offline so we cannot detail them all here. However, here are some of the biggest brands that typically offer the full range of betting facilities, including a sportsbook, casino and more. This list is far from comprehensive but does cover many of the UK’s most popular sites. Note that levels of protection can and do change so check the Ts and Cs at the specific sites before joining.

High

- Betfair

- Coral

- Paddy Power

- BetVictor

- Betway

Medium

- Sky Bet

- William Hill

- Ladbrokes

- Bwin

No Protection

- LeoVegas

- Betfred

- Tote

- 12bet

- MansionBet

As you can see, most of the biggest names in UK betting offer some form of protection, be it medium or high. The most notable exception to that is Betfred but with a company like that, you can look at their reputation and, perhaps more importantly, the fact that they consistently post huge margins. This, plus the fact that owners Pete and Fred Done are among the richest people in the UK, suggests that they are unlikely to have any financial issues in the foreseeable future.

Overall though, relatively few betting companies offer the highest level of protection. The vast majority fall into one of the two tiers below, with a roughly even split between those that offer medium protection and those that are classed as the UKGC as offering none.

As said, we would certainly not suggest you disregard a site just because of the company’s lack of protection, nor assume that they cannot be trusted. The highly reputable Betfred is a case in point. However, if you want to be ultra-cautions, especially if you make large deposits and bets, picking a bookmaker with the highest level of protection is a wise move.